amazon flex quarterly taxes

You can plan your week by reserving blocks in advance or picking them each day based on your availability. Organize Your Packages Ahead of Time.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply.

. You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. Amazon income taxes for the quarter ending March 31 2022 were -1422B a 16596 decline year-over-year. This includes things like sales tax and shipping fees.

Take Advantage of Reserve Shifts. With Amazon Flex you work only when you want to. Here are four steps to help guide you through the process and help ensure accuracy while maximizing your return.

The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. Just claim the 1099 next year. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by.

Select the right tax forms. Work During Inclement Weather. Yes Amazon Flex Drivers Really Can Make 25 per Hour.

Increase Your Earnings. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. You may also need to.

Amazon income taxes for the quarter ending December 31 2021 were 0612B a 813 increase year-over-year. Drive a Fuel-Efficient Vehicle. Louis MO Boston MA Cincinnati OH Salt Lake City UT.

How Much To Put Away For Quarterly Taxes. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday. Get to the Fulfillment Center Early.

Write Your Gas and Repairs Off as a Business Expense. Ad We know how valuable your time is. We are actively recruiting in.

Amazon Flex quartly tax payments. Sign out of the Amazon Flex app. The form will be filled out by Amazon who is required to provide.

I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k. Choose the blocks that fit your schedule then get back to living your life. Driving for Amazon flex can be a good way to earn supplemental income.

You are required to provide a bank account for direct deposit which can take up to 5 days to process. Select Sign in with Amazon. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. The 1099-K is a sales reporting form that provides the IRS with your monthly and annual gross sales information. But this year while the.

Last year Yahoo Finance reported that Amazon AMZN paid a shockingly low amount in federal income taxes in 2018 on more than 11 billion in profits. Keep in mind that Amazon does not withhold or. Only available in limited areas these deliveries start near your current location and last from 15 to 45 minutes.

Get started now to reserve blocks in advance or pick them daily based on your schedule. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. In most cases your TIN is either an Employer Identification Number EIN or a Social Security Number SSN.

Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments. Tap Forgot password and follow the instructions to receive assistance. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and.

With Amazon Flex you work only when you want to. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022. Amazon income taxes for the twelve months ending March 31 2022 were 1213B a 7163 decline year-over-year.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. Pickups from local stores in blocks of 2 to 4 hours. If you have a lot more 1099 side work you can add to your estimated quarterly due.

Because working for Amazon Flex makes you an independent contractor youll be responsible for withholding money for your taxes. Taxpayers a TIN is required by the IRS for the administration of tax laws. Work During the Holiday Season.

With only Flex amount stated youll be well below that number. Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my cash flow. Once your direct deposit is on its way Amazon Flex will send you an email to let you know.

By completing the Tax Interview in your seller account you will be providing Amazon the appropriate tax identity in the form of a W-9 or W-8BEN form. Knowing your tax write offs can be a good way to keep that income in your pocket. And heres something thats really important.

You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. You expect your withholding and credits to be less than the smaller of. The 1099-K form is your best friend.

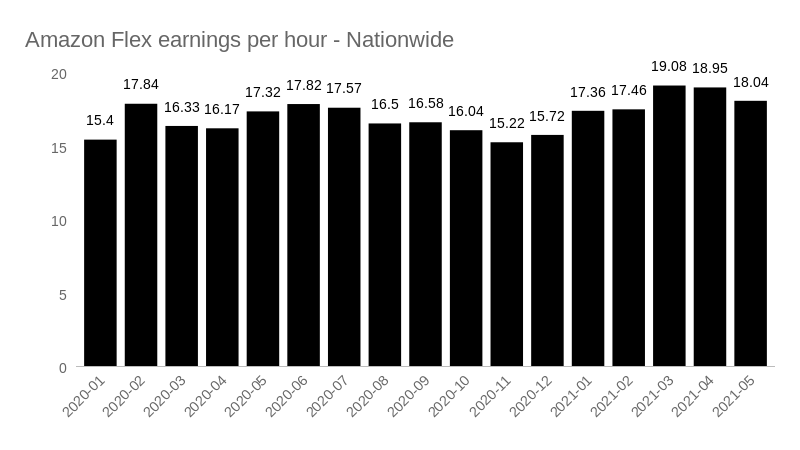

Gig Economy Masters Course. Amazon Flex drivers can make about 18 to 25 per hour. Make estimated tax payments.

Amazon annual income taxes for 2021 were 4791B a 6734 increase from 2020. Amazon annual income taxes for 2020 were 2863B a 206 increase. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year.

Take advantage of tax write-offs. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Individual online sellers are not responsible for filling out a 1099-K.

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Quarterly Taxes In An Instant

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

Tax Guide For Self Employed Amazon Flex Drivers Goselfemployed Co

How To Do Taxes For Amazon Flex Youtube

Us Gig Worker Survey Most Commonly Missed Tax Deductions

How To File Quarterly Taxes In An Instant

How To Pay Taxes For Amazon Flex R Amazonflexdrivers

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How Much Do Amazon Flex Drivers Make Gridwise

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels